Unit of production method definition

By quantifying the units produced, companies can evaluate their productivity, assess the efficiency of their production processes, and make informed decisions regarding resource allocation and capacity planning. A unit of production refers to the smallest measure of output or product that is produced within a given period of time. It represents the individual items or units that are manufactured or processed in a production process.

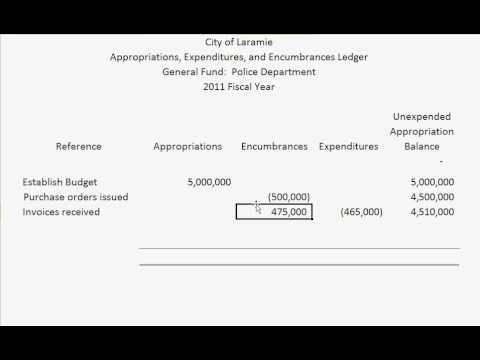

The diagram below sets out an analysis of the units of production depreciation method. While most small business accounting software does not offer depreciation calculation, they do make it easy to record both accumulated depreciation and depreciation expense. Be sure to check out The Ascent’s small business accounting software reviews to help you make your choice. Given the above assumptions, the amount to be depreciated is $480,000 ($500,000 minus $20,000). Dividing the $480,000 by the machine’s useful life of 240,000 units, the depreciation will be $2 per unit. If the machine produces 10,000 units in the first year, the depreciation for the year will be $20,000 ($2 x 10,000 units).

What are Plant Assets? – Financial Accounting

The analysis was conducted by the Regional Plan Association, a nonprofit advocating for sustainable growth in the tristate area. New Jersey lacks more than 210,000 units that extremely low income families can afford, and is the seventh-most expensive state to afford a modest one-bedroom rental, according to studies by the Washington, D.C.,-based National Low Income Housing Coalition. The couple have architectural plans for a 400-square-foot studio apartment with an accessible bathroom and kitchenette that would be built in the corner of their yard, and have bids from contractors.

Tesla production by quarter 2024 – Statista

Tesla production by quarter 2024.

Posted: Mon, 15 Apr 2024 07:00:00 GMT [source]

The most recent report says that Model Y production in Texas reached an all-time high, while COGS per unit improved to an all-time low. Tesla’s first gigafactory was its lithium-ion battery cell plant, which makes 2170-type cylindrical battery cells in partnership with Panasonic, as well as other products (drive units, power electronics, energy storage systems, and parts). For example, the use of fertilizer improves crop production on farms and in gardens; but at some point, adding more and more fertilizer improves units of production the yield less per unit of fertilizer, and excessive quantities can even reduce the yield. A common sort of example is adding more workers to a job, such as assembling a car on a factory floor. At some point, adding more workers causes problems such as workers getting in each other’s way or frequently finding themselves waiting for access to a part. In all of these processes, producing one more unit of output will eventually cost increasingly more, due to inputs being used less and less effectively.

Units of Activity Depreciation Example

If the asset is rarely used, its depreciation will be lesser and an asset will have greater depreciation for years when it is heavily used. While you’ve now learned the basic foundation of the major available depreciation methods, there are a few special issues. Until now, we have assumed a definite physical or economically functional useful life for the depreciable assets.

- Ask a question about your financial situation providing as much detail as possible.

- Equivalent Units of Production is a more accurate method to determine whether the proposed output of the process will be able to meet or exceed that budgeted for.

- Depreciation rules are established by the IRS and directly affect your business taxes at year’s end.

- And you also know a properly maintained WidgetMaker 3000 is expected to produce 90,000 Widgets during its lifetime.

- Understanding the unit of production is also essential for cost analysis and pricing strategies.